The phrase “Mergers and Acquisitions” often evokes images of Wall Street titans trading vast sums of money to engage in a hostile takeover of a rival business; however, in practice, many of the business acquisitions we observe on a regular basis involve friendly parties, including the sales of businesses from their founders to long-term employees.

In many of these “friendly” transactions, the Seller offers to finance some (or all) of the purchase price, typically by way of a promissory note (a “Seller’s Note”). Often, Sellers in these scenarios are not seeking to earn significant interest on the loans; they are simply trying to assist the Buyers and provide for smooth successions. Both parties may initially anticipate that the Seller’s Note will be below market rates or perhaps not bear any interest. However, despite their good intentions, a low or interest-free loan under these circumstances can create a problem for the Seller due to a concept known as imputed interest.

From the IRS’s perspective, these loans may not be treated as low or interest-free. Instead, the IRS may determine that the Sellers “should” have earned interest even if they did not, and when tax bills are calculated, the IRS will impute that interest as additional income to the Sellers. The amount of imputed interest is based on a rate published monthly by the IRS, known as the Applicable Federal Rate or “AFR”. By charging a rate at or above the AFR, a Seller can realize actual interest income to satisfy the associated tax liability.

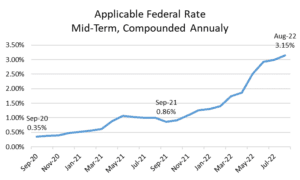

There are several AFRs published by the IRS each month – these depend on the length of the loan and the frequency of the compounding. The AFR rates are calculated based on market factors and subject to variation. In recent history, the AFR has been very low, often below .50%, so the risk (and related tax consequences) of imputed interest was relatively low. However, in the past year, the AFR has dramatically increased, and it has begun to exceed rates that may have been viewed as “market” even just a few years ago. The following chart shows the trend of a benchmark AFR for a 24-month period from September 2020 through August 2022.

While traditional lenders will certainly be familiar with the concept of imputed interest, it should be a consideration of anyone extending credit. In our experience, however, many Sellers are unaware of the risk. As noted previously, with increases in interest rates across the global markets, the AFR has risen as well. In this environment, it is even more important to consult professional advisors when structuring transactions – particularly those with Seller financing – even when it’s a “friendly” deal. Exposure to imputed interest is just one of the many risks that can be mitigated through proper deal structure.

For more information, contact the Davis, Agnor, Rapaport & Skalny attorney with whom you typically work, or one in our Business Planning & Transactions Practice Group.